In my previous article on allodial titles and property rights, I stated that a true allodial title that would provide you with full ownership of your land does not exist today, or at least not in North America. During times of economic crisis, governments tend to increase regulations and raise fees and taxes, especially on property owners. This is unfortunate, as allodial titles could have served as a protection against the higher property taxes that governments are likely to enact in this decade. In fact, many cities in Canada and the US have already increased their property taxes in ways that can become burdensome for a property owner.

Luckily, there do exist other forms of investments that have a sort of allodial title, investments which are not susceptible to yearly taxes. These investments are truly yours. If you have to pay a yearly tax on a particular investment, its real owner is questionable.

Allodial title on gold and silver?

If you own gold or silver in its physical form–we’re talking about actual bullion, not stocks or paper gold–and this gold or silver is in your possession, whether it is on your person or stashed somewhere else, then you obtain a type of “allodial title” on it. This is one of the best and rarest features of any investment. This may prove to be one of the most important characteristics of any investment. In this upcoming decade, perhaps you ought to be worried less about the return on your assets, than about the return of your assets. While bullion does not have a dividend yield, it does have an internal yield.

Cases like MF Global, among others, whereby companies essentially stole investors’ money from their investment accounts and placed risky bets and lost everything when things went sour, are a consequence of our current, over-leveraged paradigm. Any investment that is not in your hands is subject to third-party risk. Going forward, this will be evermore important to take into consideration. Just as we should not put all of our eggs in one basket, it is equally advisable not to hold a a large amount of your money in investments that you would not have full control over during an economic crisis.

The more control you have over an investment, the less risk you are exposing yourself to; instead of owning “paper,” strongly consider owning the “real” thing. What do I mean by this? If you are going to own gold, own at least a good portion of it in its physical form (bullion), instead of only in ETF’S and stocks. Remember that this is not investment advice, but only my opinion–I am not a financial adviser.

Gold Confiscation?

But wasn’t gold bullion confiscated during the Great Depression?

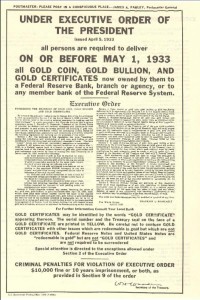

Yes and no. In 1933, President Franklin D. Roosevelt signed executive order 6102, which prohibited individuals, partnerships, corporations, and associations from hoarding gold coins, gold bullion, and gold certificates. Violation of this order was punishable by fine of $10,000 (more than $180,000 today) and/or up to ten years in prison. However, there were exceptions:

-Artists, jewellers, dentists were exempt from the order;

-Those who owned less than 5oz of gold were exempt;

-Rare and collectible gold coins were exempt;

-Gold stored outside the US was exempt.

Despite this executive order, there was only one account of prosecution of this order. The prosecution of this order was carried out on Frederick Barber Campbell who stored his gold in an “authorized” bank safety deposit box. From a 1933 article in Time Magazine:

“The circumstances of the case were that a New York attorney, Frederick Barber Campbell, had on deposit at Chase National over 5,000 troy ounces (160 kg) of gold. When Campbell attempted to withdraw the gold Chase refused and Campbell sued Chase. A federal prosecutor then indicted Campbell on the following day (September 27, 1933) for failing to surrender his gold. Ultimately, the prosecution of Campbell failed, but the authority of the federal government to seize gold was upheld, and Campbell’s gold was confiscated.”

This case proves the point of third party risk. The only case of prosecution of this order was from someone who had his gold stored at a bank. Gold certificates were reportedly all confiscated as well. In the event of another executive order like this one, you can expect gold certificates, mutual funds, and ETF’s to be confiscated as well. No known case of prosecution were reported from individuals who had gold in their possession.

If this order were again to come into effect in the future, it would be questionable if individuals would be prosecuted. The corporations, individuals, and associations who do not have an “allodial tittle” to their gold are likely to be the ones if prosecuted, however. Note that silver was NOT confiscated, only gold. Note too that while there was a similar order in Australia, there was no gold confiscation in Canada. But that doesn’t mean it could not happen in the future. Things are different now. Take a look at what happened in 2011 in Montreal to Kitco, one of the most reputable international precious metals company: Kitco was raided by 175 Revenue Quebec employees on alleged tax evasion charges. Although no charges were pressed, it is an indication of how governments have the potential to regulate (“regulate” being, of course, a euphemism in this case for “take over”) precious metals companies.

There are ways to minimize your exposure to reporting activities and protect the “allodial title” on precious metals.

Government Reporting on Gold and Silver in the US

Purchases from reputable gold dealers are reportedly made confidential as they do not report to government. However, when you sell gold and silver, it may be reported by a 1099 IRS form. The following are exempt:

Silver

– American Silver Eagle Coins

– Canadian Maple Leaf Silver Coins

– Austrian Philharmonic Silver Coins

Gold

– American Gold Eagle Coins

– American Gold Buffalo Coins

– Gold Austrian Philharmonic Coins

The following are not exempt from an IRS 1099 form:

Silver

– .999 fine silver bullion bars (any sizes)

– .999 fine silver bullion rounds (any sizes)

– $1000 face value bag or more of 90% silver coins

Gold

– Canadian Gold Maples (1 oz)

– South African Krugerrands (1 oz)

– .999 fine gold bullion bars (any sizes)

I would like to add a note of caution: an investor can avoid the 1099 reporting requirements by simply being strategic by buying a combination of coins that are exempt. However, arranging the sales of such exempt bullion in multiple transactions to avoid the IRS form may lead the dealer to file a Suspicious Activity Report.

Government reporting on Gold and Silver in Canada

In Canada, any transaction above $10,000 will be reported to the government. As mentioned above, even in Canada dealers are required to file a suspicious activity report on someone who is constantly purchasing and selling below the threshold.

In the end, even though precious metals have a type of allodial title to it, there are still precautions that you want to take before purchasing or selling precious metals. Silver in general is less exposed to regulations and rules; remember, too, that it was not confiscated in the 1930’s. Of course, there are NO guarantees with anything, even bonds. Anyone telling you otherwise is foolish and hasn’t studied recent history. Owning the physical bullion under your full control will help limit your exposure to third party risk and confiscation.

Post your thoughts below.