Despite what is commonly understood, the Canadian banking system is NOT as strong and resilient as most people might assume. According to the World Economic Forum, Canada is ranked #1 in the world for “the most sound banking system in the world”. I am not sure what world they live in, though. The Canadian banking system is no different than most of its counterparts, and Canada’s economic crisis is just as inevitable.

Key Arguments about the Canadian Banking System’s unsound economics:

- Canadian banks received a bailout in 2009 from the Fed, BoC, and CMHC;

- The key reason underlying this bailout was that Canadian banks are actually under-capitized;

- Canadian banks operate under a fractional reserve system, with 0% reserve requirement;

- The Canadian Deposit Insurance Corporation does not hold enough cash on hand;

- Canadian banks hold the majority of their balance sheets on non-productive assets;

- The Bank of Canada has virtually no gold left to back their monetary system

Canada’s Secret Bank Bailout and the CMHC

Although conventional wisdom tells us that the US banks received a bank bailout and the Canadian ones did not, Canadian banks did in fact receive a bank bailout. If Canadian banks are as strong as the media portrays them to be, then why did they need to be rescued in 2008? And why did they get rescued by the combination of the US FED, Bank of Canada and the CMHC in that and the following year? The exact details of these bailouts are not even accessible to the public, even though, quite ironically, Canadians paid for it through their taxes. The Canadian Centre for Policy Alternatives, however, did release a report with some estimates on the publicly available data from the Canadian Mortgage Housing Corporation (CMHC, the Freddie Mac of Canada).

To prevent a US-style housing catastrophe, the US Fed and the BoC offered short-term collateralized loans to Canadian banks, and the Canadian Mortgage Housing Corporation (owned by the Canadian federal government) bought $69 billion worth of mortgages off Canadian Chartered Banks. Does this sound familiar? Of course it does–the US FED is doing the same with their quantitative easing programs.

To prevent a US-style housing catastrophe, the US Fed and the BoC offered short-term collateralized loans to Canadian banks, and the Canadian Mortgage Housing Corporation (owned by the Canadian federal government) bought $69 billion worth of mortgages off Canadian Chartered Banks. Does this sound familiar? Of course it does–the US FED is doing the same with their quantitative easing programs.

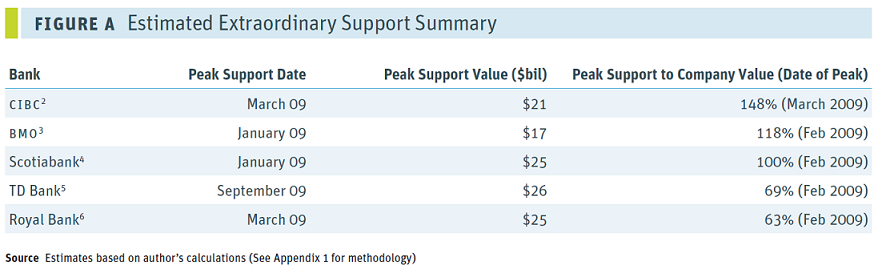

At its peak, support Canadian banks received reached $114 Billion. That is 7% of the entire Canadian economy in 2009 or $3,400 per Canadian.

As one might expect, the CEOs of each of the BIG 5 CANADIAN BANKS were ranked among the highest paid CEOs of Canada at the height of government support between 2008 and 2009. Edmund Clark of TD Bank saw his overall compensation jump from $11.1 to $15.2 million in 2009.

It is true , we have the only banks in western world that are not looking at bailouts or anything like that… and we haven’t got any TARP money.

Why Did the Canadian Banks need to be Bailed Out?

Canadian Banks are in many respects no different from their US counterparts: they practice a fractional reserve system (which will be explored in the next section) which allow they to use the “money-created-out-of-thin-air” approach, charge interest, and offload their risk to the taxpayer in the event of a CMHC insured mortgage default or a bank-run. Talk about something for nothing! In the end, Canadians, like Americans, were involved in reckless money borrowing. although–and this may be a surprise for some–Canadians are currently in debt-levels far beyond those of the Americans.

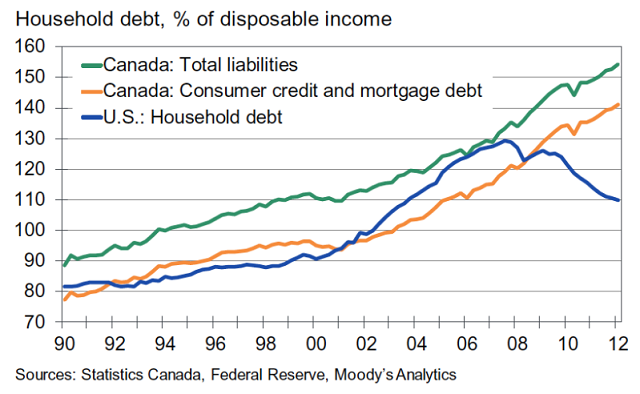

In the US sub-prime crisis of 2007-2008, the bubble popped; but in Canada, the bubble continues to grow and create further mal-investments from low interest rate environments. Canadian debt/disposable income levels are approaching 160%, far above the US equivalent of 128% before the US debt crisis.

Although conventional wisdom points out that it was the US banking system that led to the sub-prime banking crisis, the Canadian banking system has had and still has similar programmes, and yet they are seldom discussed. For instance, the CMHC temporarily dropped the down payment for a qualified insured mortgage to 0% from March 2006 to October 2008, to inflate and create artificial housing demand. As of October 2008, the CMHC demands a minimum of 5% down payment. Yet, some banks offer a 5% cash back component to their mortgage which enables someone to buy a house in Canada with, once again, NO money down! Most of the cash back mortgage programmes should have ended in October 2012, but whether they really have is still shrouded in mystery. The CMHC permits the minimum 5% down payments to come from borrowed sources (credit cards, credit line.. etc), provided that it is disclosed. Sounds like sub-prime mortgages still do exist in Canada.

In order for this trend to continue, debt must continually be increased, and this is self-serving, for just as debt levels increase, so must interest payments. To increase debt levels, either the interest rates must be lowered, or the rules loosened.

Interest rates can hardly be decreased any further, as they are already nearing the zero mark–but mortgage lending rules can still be loosened. Of course, instituting more lax mortgage rules really only increases the number of non-qualified buyers now ready to purchase housing, once again further artificially increasing the price of housing.

If debt is not increasing, it is contracting. Just as money can be created out of thin air, so too can this very same money be deleted. If even the slightest number of people would start to default, the money supply would quickly begin to vanish–thus resulting in a bank’s worst nightmare: deflation.

Although highly feared by many politicians and economists as dangerous, deflation should be accepted, as this creates lower prices for everything during the time of crisis; mal-investmensts are liquidated, and the economy restores itself to equilibrium. However, central banks across the globe are counteracting this natural trend by creating stimulus programs to maintain an inflationary cycle so that the system will not self-implode.

Canada’s debt crisis was temporarily solved by central banks in 2008, however the situation now is much more grave and the next time a economic slowdown occurs, the Canadian banks might not be able to survive a further debt crisis and real estate may finally collapse in Canada. Due to mortgage-backed securities (a financial instrument used by banks to package and sell multiple mortgagees together in order to get these loans off the books of banks), banks offloaded their mortgages to the CMHC as part of the aforementioned rescue package they received. The CMHC actually holds over $300 billion worth of Canadian mortgage paper, along with insuring an additional $600 billion worth of mortgages. The CMHC now owns the majority of these MBS and it is the Canadian taxpayer who will have to foot the bill for these mortgages in the event of a default.

The Canadian Fractional Reserve Banking System in Canada

Many people believe that banks safeguard their deposits in their vaults and maintain a liquidity ratio on or about 100%; in other words, there is a cherished and widespread belief that banks only lend out the money which they have on deposits. This is a fallacy: today’s banking system reality is far different.

Today, most banks around the world, and if not all, operate under a fractional reserve banking system. ‘Fractional reserve banking’ allows banks to keep only a fraction of their deposits while lending out the rest with interest to other clients. Banks are therefore capable of loaning out money which they do not in fact possess. The assumption, of course, is that people will not all withdraw their funds from the banking system at the same time. If so, this will result in a bank runs, as seen in much of Europe in the last few years.

However, unlike the US banks, where they must maintain a liquidity reserve requirement of 10%, Canadian banks have a 0%reserve requirement, thus affording them the ability to create a virtually unlimited amount of money “out of thin air” (see: “Fractional Reserve Banking System“). In the end, when banks create money due to the fractional reserve system, debt is also created. For instance, when you are approved for a mortgage at a bank for $500,000, that artificial money was a digital entry into your bank based on the promise to pay it back with interest. It did not come from their reserves or deposits.

The problem with this system is that it exponentially increases credit–and consequently debt–while living in a finite world with finite resources. Credit has grown so significantly over the real hard cash that you carry in your wallet that our economy is dependent on credit for its necessary expansion. If credit doesn’t expand, the economy comes off its “high” and needs to return to equilibrium and rid itself of all the mal-investments. Sounds like a debt Ponzi scheme? That’s because it is.

The Canadian Deposit Insurance Corporation

What about the Canadian Deposit Insurance Corporation (CDIC) which insures your money at the bank up to $100,000? According to the CDIC’s 2011 Annual Report, the CDIC protects $604 billion CAD in total eligible deposits, and has $2.2 billion CAD in assets to meet insurance claims. This amount represents 0.36% of total eligible deposits.

Oh yeah, the Canadian banking system is “so secure.”

In the not improbable event of a small group of people demanding their money from banks, the CDIC will be on the hook, and will require a bailout from the Canadian taxpayer.

The CDIC is also authorized to borrow up to $17 billion if necessary from the federal government or from the markets, and may request additional funds from Parliament.

The CDIC protects the banks from their debt Ponzi scheme, but not the consumer. Just take a look at many places in Europe, such as Greece and Spain, where people are struggling to retrieve their own money from their very own bank accounts. Some banks have even closed their doors to the public. When banks lend out all of their customer’s deposits, multiple times over, if even a fraction of depositors come back to the bank to withdraw their money, they will be very surprised to learn that the coffers had been emptied long before.

The Bank of Canada Has Virtually No Gold in Reserves

The Bank of Canada has negligible gold reserves. It currently stands, at 3.4 tonnes, in 80th place in the world in terms of countries with the most gold in reserves. Even countries like Mauritius, Nepal, Macedonia, and Sir Lanka have more gold than Canada. The gold share of national foreign exchange reserves is 0.3%. In other words “zero”. The majority of Canadian reserves are in US Dollars and other foreign currencies.

Unlike Canada, its counterparts have significantly more gold backing their currency. Gold reserves can provide a solid groundwork for a currency backing it up with an commodity with intrinsic value. (For information regarding Canada’s gold, see here.)

Banks Focus their Balance Sheets on Non-Productive Assets for the Economy

Money tends to flow in the path of least resistance. In other words, governments have been foolishly left to decide where investments should be re-directed, instead of leaving this task to the free market. For instance, real estate in Canada and in the US are heavily subsidized investments and in my view has caused many distortions in our free market. The CHMC is offering mortgages at a 5% downpayment, ultra-low interest rates, first-time home buyers credit, and other tax incentives that have created artificial demand for real estate. But real estate, unlike a business, does not provide any net value to an economy.

Instead of focusing investments on small to medium-sized businesses, banks focus their attention on real estate as the majority of their balance sheets include real estate mortgages. In the end, small businesses suffer as they have difficulty accessing the capital necessary to growing their business, thus lowering the supply of goods entering into the market, which consequently keeps prices higher.

Additional Resources About the Canadian Banking System

An insightful documentary “Oh Canada” was created to expose the fraud of the Canadian banking system. There are also plenty of other documentaries listed in our economic documentary library that you can watch for free. These informative videos provide some reasons as to today’s global banking crisis.

Post your thoughts below.