Over-saturated real-estate activity reflects over-saturated markets. Eventually, optimism runs dry and the period marked by over-exuberance recedes, and we notice the good times are over. What’s one way to track this? The Skyscraper Index.

Skyscraper Index

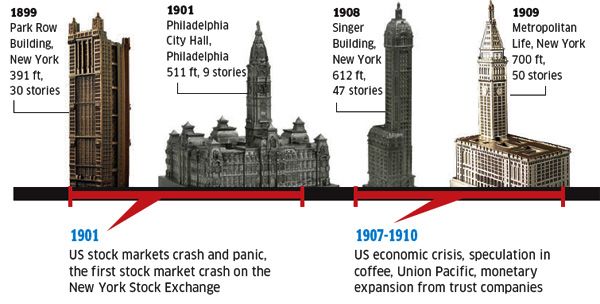

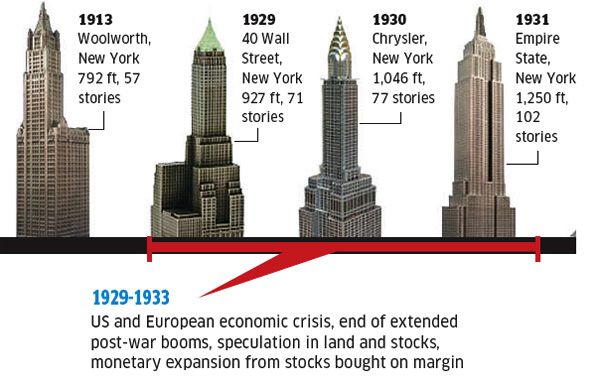

The Skyscraper Index, developed in 1999 by Andrew Lawrence of Dresdner Kleinwort Wasserstein, shows that the world’s tallest buildings have risen on the eve of economic downturns. At the end of the Roaring Twenties, the United States were constructing three of the world’s tallest buildings of that era: 40 Wall street, the Chrysler Building, and the Empire State Building. Although it is just a theory, it has proven itself to be relatively accurate in the last century.

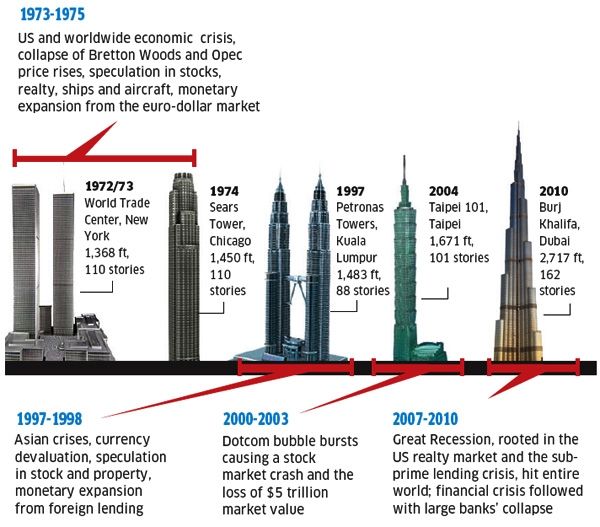

One interesting note: when Richard Nixon de-linked the US dollar from gold in 1971 ,once the Sears Tower was brought to completion in 1974, no new record was achieved in the US. Globalization was taking shape, jobs were being sent abroad, taxes, and inflation trade deficit and debt were on the rise in the US. In other words, the start of the decline of the West could have been even seen on its skyline. The new world’s-tallest-buildings passed from the western hemisphere to the new economic powerhouses of the Middle and Far East. We are talking about those countries that actually produce on a grand scale and are the creditors of western debt: Asia (goods) and the Middle East (oil).

The Sky City One Skyscraper, China

The completion of the Burj Khalifa in Dubai in 2009-2010 marked the great recession and nearly bankrupted Dubai. Now China has unveiled its plans for the Sky City One. The plan for this building is to be prefabricated and built on-site, within a time frame of just ninety days, with the completion date reportedly set for June 2013. Once completed, Sky City One will rise 10 meters higher – at 838 meters (2,749 feet) – than the Burj Khalifa in Dubai. Sky City’s construction cost is estimated at $620 million; the Burj Khalifa, took five years to build at a cost of $1.5 billion.

If the Skyscraper Index shows evidence of a near market turnaround, this will not be good news for property speculators in 2013-2014. How will this affect Canada? According to Statistics Canada, Canada exported $16.3 billion worth of merchandise to China in 2011 (mainly commodities and natural resources). This will surely be used in construction of this skyscraper. Yet, this is little less than 4% of total Canadian exports to China. The US, on the other hand, exports $130 billion to China. The US may be affected more by a Chinese decline, which in the end, of course, will not be good for Canada. The fact is, we live in a global economy and everyone is affected by each other’s crises.

Although the completion of Sky City One Skyscraper will definitely set back an exuberant market in China as there are layoffs from less consumer demand. This may not be a good time for Chinese property speculators, but it will be good news for people like Jim Chanos (famed for his ENRON short-selling is now shorting Chinese banks).

Adding fuel to the fire, Beijing recently initiated a 20% capital gains tax on property transactions to dampen real-estate activity and construction. As seen in a recent 60 minutes program about China’s property bubble, there are empty uninhabited cities China (yes, cities). If you haven’t seen it, check it out here. Unreal!

Other than China’s property bubble, according to the Economist, Canada has the most over-valued real-estate in the world. In my next article I talk about how to pull a Chanos on the Canadian property market.

Any comments on China’s property bubble? Post it below.