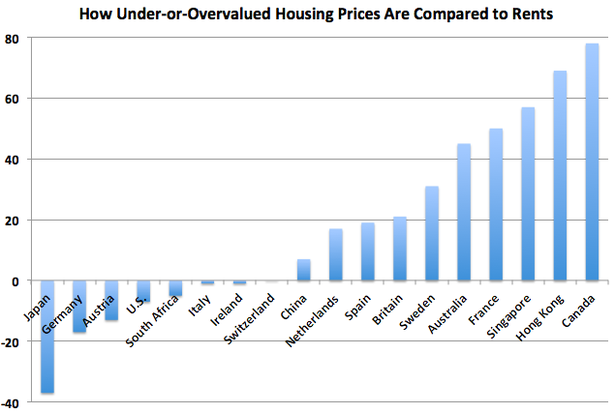

While the mainstream media is only now beginning to acknowledge a dip in real-estate price evaluations in Canada. We have been raising the flag about this for over a year. According to The Economist, Canada’s housing market is the most over-valued in the world when analyzing its rents and income to price.

“Overvaluation is especially marked in Canada, particularly with respect to rents (78%) but also in relation to income (34%). Mark Carney, the country’s central-bank governor, who is soon to jump ship to join the Bank of England, where he takes over from Sir Mervyn King in July, may have shown good market timing with his move to London as well as a deft hand in negotiating his lavish remuneration.”

Any analyst who believes this is only a soft correction and that prices will eventually go back up is not on the right track. Here’s why.

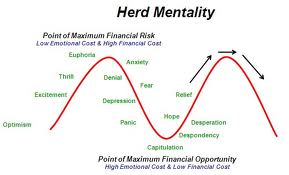

As stated in a previous article, in order for prices for housing to go back up, debt has to be increased. When debt is already at an all-time high, that will be very hard to do. Canadians are in debt levels never seen before, at 160% debt/income. You see, debt is the “fuel” to the real-estate market. The market is no longer overly optimistic; the general mood has changed from “greed” to “fear”. This is a typical buyer’s psychology also know as the “herd mentality”. One sheep, then two sheep, then three, four…and then the whole flock comes rushing to the door to sell and get out of the market.

I’m not even being pessimistic.

Take away the ability to borrow money for a mortgage and home prices will come crashing down. That is basic economics. If we have reached the saturation point with high levels of debt, the market is distorted. PEOPLE ARE SIMPLY OVER-LEVERAGED and there are NOT enough new people entering into the market to fulfill the need for further price increases. There are too many people on one side of the equation, and as soon as people start to realize this, the pendulum moves to the other side, much like a stock market swing in a “doomed” stock. Sales in major Canadian cities are down as much as 28% so far.

Canadian Housing Bubble Casino

Why am I comparing real-estate to the stock market? Because it is the new casino. A slow-paced casino, of course, as it is much harder to buy and sell as it requires much more effort than roll of a die. However, a large part of the real-estate game consists of “paper investments:” stocks in real-estate companies, MBS, REIT’S, mortgage bonds, specialized mutual funds, etc. If people do not purchase these products, it magnifies the problem, creating a more severe down-turn as there will be less access to financing for Canadian housing.

Let’s play devil’s advocate. You might say, “sure, but Canada is not foolishly involved in reckless sub-prime mortgages like the US.” But they are: a sub-prime mortgage by definition is a mortgage granted to someone who does not pursue the traditional route for a mortgage at a bank with the minimum down payment of 25%. The CMHC-insured mortgages allow for a 5% minimum down payment (and according to the CMHC, this 5% can come from borrowed sources). What does this sound like?

Debt is a double-edged sword. It magnifies gains on the way up, and it also magnifies the losses on the way down. If excessive debt were not used in the market and people needed to wait until they accumulated the required minimum down payment of 25% for a traditional mortgage, prices would never have gotten so out of hand. Instead we are playing a real-estate roller-coaster game abetted by foolish policies.

Why is this market doomed to fail?

Debt cannot be expected to continue to expand forever. Why? Because we live in a physical world bound by the limitation of finite goods. If we lived in Fantasy land, or if we were able to somehow introduce fusion technology to multiply products that we could then use at no added energy cost, then yes, debt could expand infinitely. But on our good planet earth, when debt is not expanding, it is contracting. Just as money is being introduced “from thin air” when mortgages are created, it gets deleted out of thin air when defaults start to occur. (Read Fractional Reserve System for an in-depth explanation of how money is created.)

In the US, there was the phenomenon known as “jingle mail,” whereby people just stopped paying their mortgages and mailed in their house keys to the bank; this is a short-cut, an alternative to foreclosure, the only real consequences of which are related to bad credit. This situation in Canada is a bit different. Mortgages in Canada are mostly all “full-recourse” obligations, meaning that even if you default on your mortgage, creditors can still come after you for a partial or full amount of the mortgage. However, a bankruptcy trustee may be able to draft a consumer proposal (a legal process that requires creditors to reduce or forgive debts). The option of last resort is, of course, declaring bankruptcy. Unlike in the US, foreclosure statistics aren’t publicly available in Canada, so there is no way to analyze this except by looking at prices.

The “Margin Call” in Canadian Real-estate

Canada is not immune to an economic crisis, even if our economy is largely resource-based. We live in a global economy, and Canada is heavily dependent on trade. Roughly 20% Canada’s entire economy relies on trade with the US. If the US doesn’t buy products from us, we go down along with them. YES, Canada has been replacing some of this demand with other trading partners, however a lot of their exports are also being shipped to the US as well. The engine of US consumerism is stalling and quite frankly overdosed with high octane “stimulus”. As you know, you cannot continually increase the octane in your fuel to get better performance with your engine. At one point the engine will blow, especially if it was not designed for it in the first place.

To think that housing will soon fall back into a linear, upward trajectory is like saying that pushing the gas pedal will increase your car’s speed to infinity. If you are living in outer space, then maybe that can happen, but in our world, markets NEED to come down in order to restore some equilibrium. The inefficiencies must be liquidated so that the regeneration of the markets can proceed from depressed levels.

As people start to lose jobs, the trend will be ever so clear. Over-leveraged buyers are faced with mortgage payment problems, especially if money is tight. As mentioned above, money gets deleted out of thin air when defaults occur and banks become reluctant to lend. They will require a bailout from the government just to stay capitalized.

At the same time, everyone in the mainstream will be saying that “nobody” saw it coming. while independent research blogs like this one have been screaming it out for months or years before it happened.

If you don’t agree, challenge it below. Every month I track the Canadian housing bubble statistics and provide an in-depth analysis of the current trend. You can see it here, or subscribe to our mailing list to get it automatically delivered to your email.